Perplexed about the process of cashing out your earnings from Poshmark? I’ve got you covered. Withdrawing funds from your Poshmark account is a straightforward and secure process, but it’s essential to be aware of the key steps and potential risks involved. In this guide, I’ll walk you through the necessary steps to cash out your Poshmark earnings, as well as provide some helpful tips and precautions to ensure a smooth and secure transaction. By the end of this post, you’ll feel confident and informed about how to safely withdraw your hard-earned money from your Poshmark account.

Key Takeaways:

- Link your bank account: In order to cash out your funds from Poshmark, you will need to link your bank account to your Poshmark account. This allows for easy and secure transfer of funds.

- Meet withdrawal requirements: Before you can cash out your Poshmark earnings, you must ensure that you have met the minimum withdrawal requirements. This may include reaching a certain earnings threshold or waiting for a specific payout date.

- Verify your identity: Poshmark requires users to verify their identity before withdrawing funds. This is a standard security measure to protect your account and ensure that funds are transferred to the correct individual.

- Expect processing time: After initiating a cash out from Poshmark, it is important to understand that there may be a processing time before the funds appear in your linked bank account. This is typically a few business days, but can vary depending on your bank.

- Consider additional fees: While Poshmark does not charge a fee for cashing out funds, your bank may have its own fees associated with receiving transfers. It’s important to be aware of any potential fees from your financial institution.

Setting up your Poshmark Account for Withdrawals

Your first step in cashing out your Poshmark earnings is to make sure your account is set up to facilitate withdrawals. This process involves linking your bank account and setting up direct deposit to ensure a seamless transfer of funds from your Poshmark account to your personal bank account.

Linking your Bank Account

To link your bank account to your Poshmark account, navigate to the Account Tab in the app and select ‘My Balance’. From there, choose ‘Manage Account’ and then ‘Direct Deposit’. You will be prompted to enter your bank account information, including your routing and account numbers. Once this is complete, your bank account will be linked to your Poshmark account, and you will be ready to initiate withdrawals.

Setting up Direct Deposit

Setting up direct deposit is an essential step in ensuring that your Poshmark earnings are transferred directly to your bank account. To do this, go to the Account Tab in the app and select ‘My Balance’. From there, choose ‘Manage Account’ and then ‘Direct Deposit’. You will be prompted to enter your bank account information, including your routing and account numbers, and then verify your account. Once direct deposit is set up, your Poshmark earnings will be automatically transferred to your bank account on a regular basis, making the cash out process seamless and efficient.

Withdrawing Funds from Your Poshmark Account

The process of withdrawing funds from your Poshmark account is simple and easy to do. As a seller, it is important to understand the different options available for cashing out your earnings and the steps involved in completing the withdrawal.

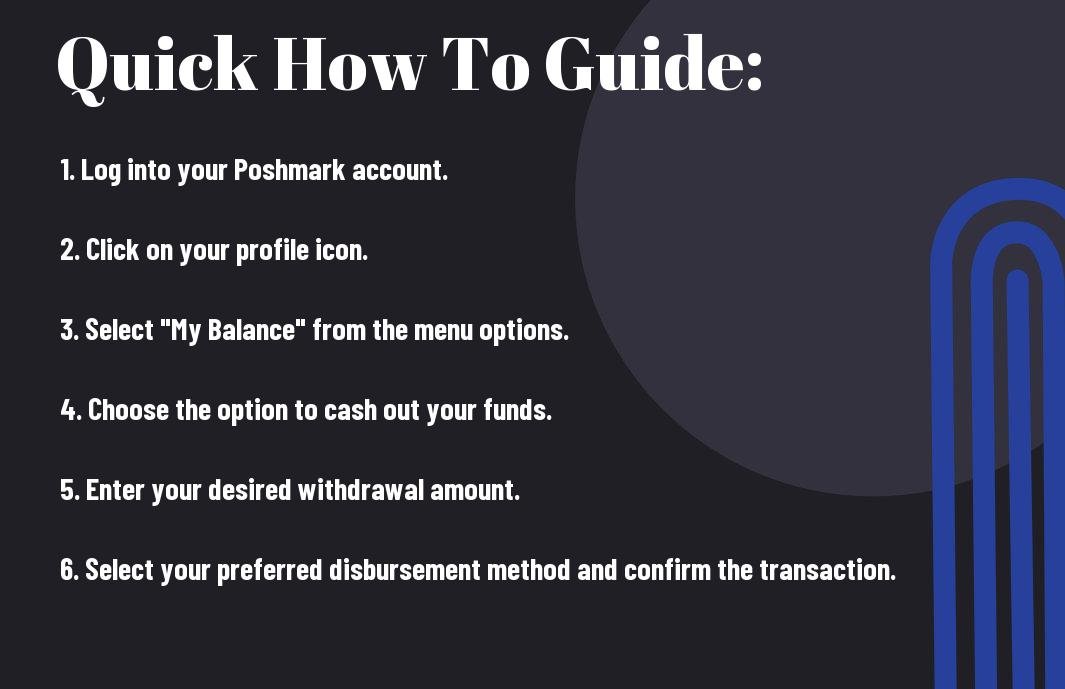

How-to Guide for Withdrawing Funds

When you are ready to withdraw funds from your Poshmark account, simply log in to your account and navigate to the ‘Account Tab’. From there, you will see the option to ‘Redeem My Cash’. Click on this option and follow the prompts to select your preferred withdrawal method, whether it be direct deposit or by check. Once you have completed the necessary steps, your funds will be on their way to you.

Tips for Maximizing Your Withdrawals

When it comes to maximizing your withdrawals from Poshmark, there are a few key tips to keep in mind. First, consider the timing of your withdrawals. It may be beneficial to wait until you have a larger sum of money in your account before cashing out, as this can help you save on withdrawal fees. Additionally, consider using direct deposit as your withdrawal method, as it is often the fastest and most convenient option. Finally, be sure to keep track of your earnings and withdrawal history to stay on top of your finances.

- Wait until you have a larger sum of money before withdrawing to save on fees

- Use direct deposit for the fastest and most convenient withdrawal method

- Keep track of your earnings and withdrawal history to stay on top of your finances

After following these tips, you can ensure that you are receiving the maximum benefit from your Poshmark earnings.

Factors to Consider when Cashing Out on Poshmark

Despite the convenience of cashing out on Poshmark, there are several factors you should consider before making a decision. Some of the most important ones include:

- Poshmark Fees: When withdrawing funds, you need to take into account the fees associated with the transaction. These fees can vary based on the withdrawal method you choose and can have an impact on the amount you receive.

- Timing: The timing of your withdrawals can be crucial, especially if you want to maximize your benefits. It’s important to understand the best times to cash out based on your financial goals and Poshmark policies.

- Financial Goals: Your personal financial goals and situation should also influence your decision to cash out. Whether you need immediate access to cash or prefer to let your earnings accumulate, it’s essential to align your cash out strategy with your overall financial plan.

- Tax Implications: Cashing out on Poshmark can have tax implications, so it’s important to consider the potential impact on your tax situation before making a withdrawal.

Recognizing the significance of these factors can help you make informed decisions when cashing out on Poshmark, ultimately leading to a better financial outcome for you.

Understanding Poshmark Fees

When withdrawing funds from your Poshmark account, it’s crucial to understand the fees associated with the transaction. Poshmark charges a flat fee of $2.95 for withdrawals under $15, while withdrawals of $15 or more incur a fee of 2.9% of the total amount, plus $0.30. This fee structure can impact the amount you receive when cashing out, so it’s essential to factor it into your decision-making process.

Timing Your Withdrawals for Maximum Benefit

Timing can play a significant role in the amount you ultimately receive when cashing out on Poshmark. Poshmark has a three-day processing period for withdrawals, and the timing of your request can impact when you receive the funds in your bank account. Additionally, understanding your own financial situation and goals can help you determine the best times to withdraw funds in order to maximize your benefits.

Conclusion

With this in mind, cashing out your earnings from Poshmark is a straightforward process that ensures you receive your hard-earned funds in a timely manner. By following the simple steps outlined in this guide, you can easily withdraw your money from your Poshmark account and transfer it to your bank account. Always ensure that you have a verified bank account linked to your Poshmark account and that you have met the minimum withdrawal thresholds. Once these requirements are met, you can confidently cash out and enjoy the fruits of your Poshmark sales. Remember to stay informed about any updates or changes in Poshmark’s withdrawal process to ensure a smooth transaction every time.

FAQ – How to Cash Out Poshmark – Withdrawing Funds from Your Poshmark Account

Q: How do I transfer funds from my Poshmark account to my bank account?

A: To withdraw funds from your Poshmark account, go to your account settings and select the “My Balance” option. From there, you can request a withdrawal and choose the bank account where you want the funds to be transferred.

Q: Are there any fees associated with withdrawing funds from my Poshmark account?

A: Poshmark charges a flat fee of $2.95 for withdrawals under $50. For withdrawals over $50, there is no fee.

Q: How long does it take for the withdrawn funds to appear in my bank account?

A: Once you initiate a withdrawal, it can take 2-3 business days for the funds to appear in your bank account. However, please note that it may take longer for certain banks to process the transaction.

Q: Is there a minimum amount that I need to have in my Poshmark account before I can request a withdrawal?

A: Yes, the minimum withdrawal amount on Poshmark is $5. You will need to have at least $5 in your account to be able to initiate a withdrawal.

Q: Can I use the funds in my Poshmark account to purchase items on the platform?

A: Yes, the funds in your Poshmark account can be used to make purchases on the platform. However, if you prefer to withdraw the funds to your bank account, you can do so following the withdrawal process outlined in the first question.